What Is Consumer Math?

Consumer math is the type of mathematics that involves practical applications in everyday life, particularly in financial decision-making. This area of study draws on a variety of different math skills, from basic addition and subtraction to more advanced algebra. Having consumer math skills is essential to being able to manage your personal finances well, encompassing things like budgeting, couponing, investing, and understanding how debt works.

When Should Parents Teach Their Kids Consumer Math?

Building the foundation for consumer math skills should start in the elementary grades with addition, subtraction, and identifying the values of coins and bills, but the more in-depth and practical applications of consumer math are best taught to students in grades 9 through 12. Topics covered in consumer math should include:

- Budgeting

- Taxes and how they affect wages and expenses

- How insurance works

- Personal banking

- Interest and how it affects loan repayment and credit card debt

- Basics of investing

These subjects require a certain level of maturity and life experience that younger students may not possess.

Why Should You Teach Your Kids Consumer Math?

Teaching kids consumer math is crucial for several reasons. First and foremost, it equips them with essential financial literacy skills that they will use throughout their lives. To be a successful adult, you need to understand how to manage your money, cover your expenses, use debt wisely, and save for the future. Once they're grown, they'll use consumer math every day, whether they're using coupons to help them save money on a purchase or researching interest rates while preparing to buy a home. Having strong consumer math skills can set kids up for a solid future.

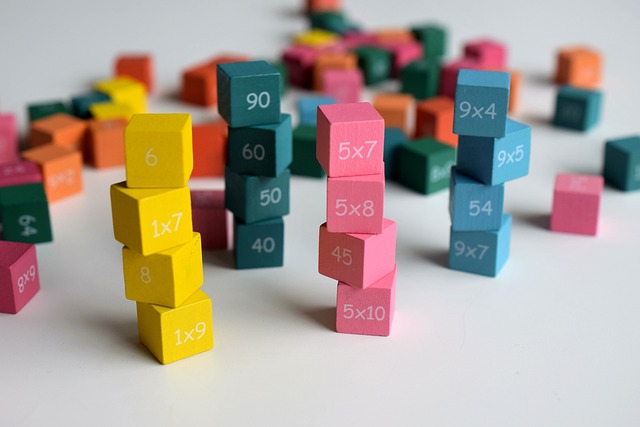

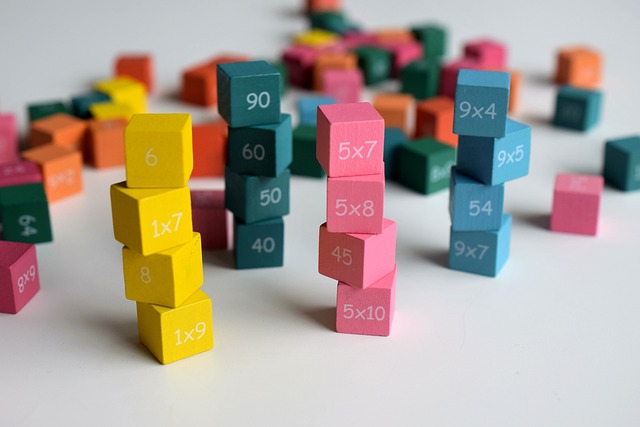

Coupon Games and Math Games for Kids

Online games can help kids absorb mathematical concepts and hone their skills in a way that's fun and engaging. Whether a game asks them to count up different amounts of money or use coupons to reduce their grocery bill as much as possible, kids can build their math skills and perhaps even compete with friends to see who can get the best scores.

- Millionaire-Style Money Game: With this fun game for all ages, kids can learn about the value of money and the relationship between money and decimals.

- Lemonade Larry: Kids can practice their multiplication skills by playing this game.

- Coffee Shop: Players use math to run their own coffee shop in this game, including buying ingredients and setting prices to make a profit.

- Names and Values of Coins: Scroll down to find a timed quiz on the values of different forms of money.

- Learn to Count Money: In this game, players add up different amounts of money to earn fish.

- Money Master: Put the right coins and bills in the box to equal the amount shown in this game.

- World of Cents: Kids can build a world of fun by playing this game, in which you construct your own playground while learning about money math.

- Making Change: This fun tool lets kids design their own coins.

Other Money and Finance Games for Kids

People of any age can learn more about managing their finances using online games, from kindergarten to the adult years. Younger kids can work on concepts like saving up for larger purchases and making smart spending decisions, while older players can practice investing in stocks without risking real money, consider how they'll manage their money in college to minimize their debt, or even take a look at how working a side gig can help them cover their expenses.

- Time for Payback: This fun game is great for older kids, as it presents a realistic picture of how their decisions can affect the costs of college and their finances after graduation.

- The Uber Game: Play this game to learn about what it's really like to try to cover your living expenses with a gig like driving for a ride-sharing service.

- Fakeonomy: This is a fast-paced stock market simulation game designed to give players a look at how buying and selling at the right times can help you gain or lose money.

- Stock Market Simulator With Real-time Data: With this tool, you can buy pretend stock in real companies and then see how the value of your investment changes. It's a great way to learn more about investing strategy without putting real money at risk.

- Cash Out: Here's a simpler game for younger kids that's centered around making change.

- Counting Money Quiz: First, kids can look over this page to review their knowledge of bills and coins. Then, they can click to take a quiz and test their knowledge.

- Money Quiz: In this game, players have to add up the money shown to get the correct total.

- Super Grocery Shopper: Grocery shopping requires careful planning and budgeting. This game challenges players to make sure they get enough to eat and have a balanced diet with a limited amount of money.

- Count Groups of Ten: With this game, kids can practice counting by tens to build fluency.

- Change Maker: Elementary-age kids will get the most out of this game, which asks players to figure out how much change they should get back for different purchases.

- Math Subtraction Quiz: Kids can use this quick quiz to practice their subtraction skills.

- One-Minute Times Table Test: Use this tool to help kids work on memorizing their times tables.

- Subtraction Quiz for Kids: Here's another quiz you can use to help kids improve their knowledge of simple subtraction.