Artificial intelligence is quickly becoming a budgeting buddy for thousands of Americans. Whether they're tracking spending or seeking investment ideas, more people are turning to AI tools like ChatGPT for help with financial decisions. A new CouponFollow survey of over 1,000 U.S. adults, including small business owners, reveals how regular AI users stack up financially against non-users.

Key Takeaways

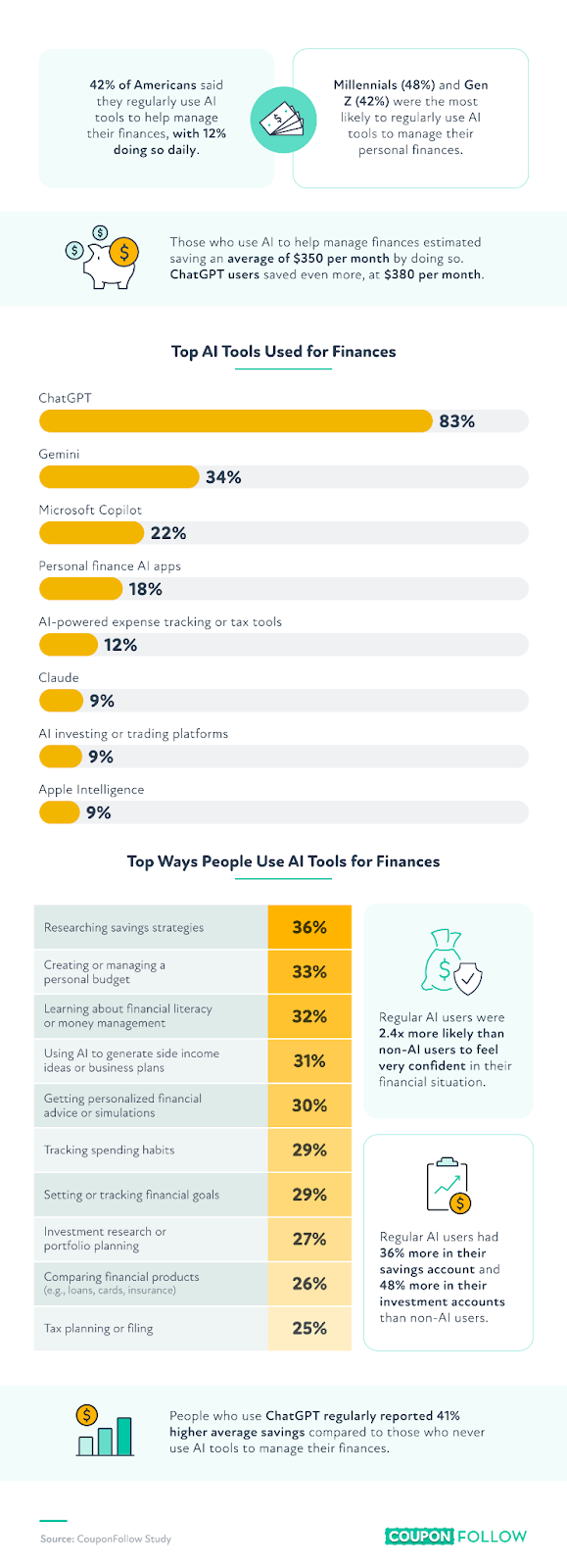

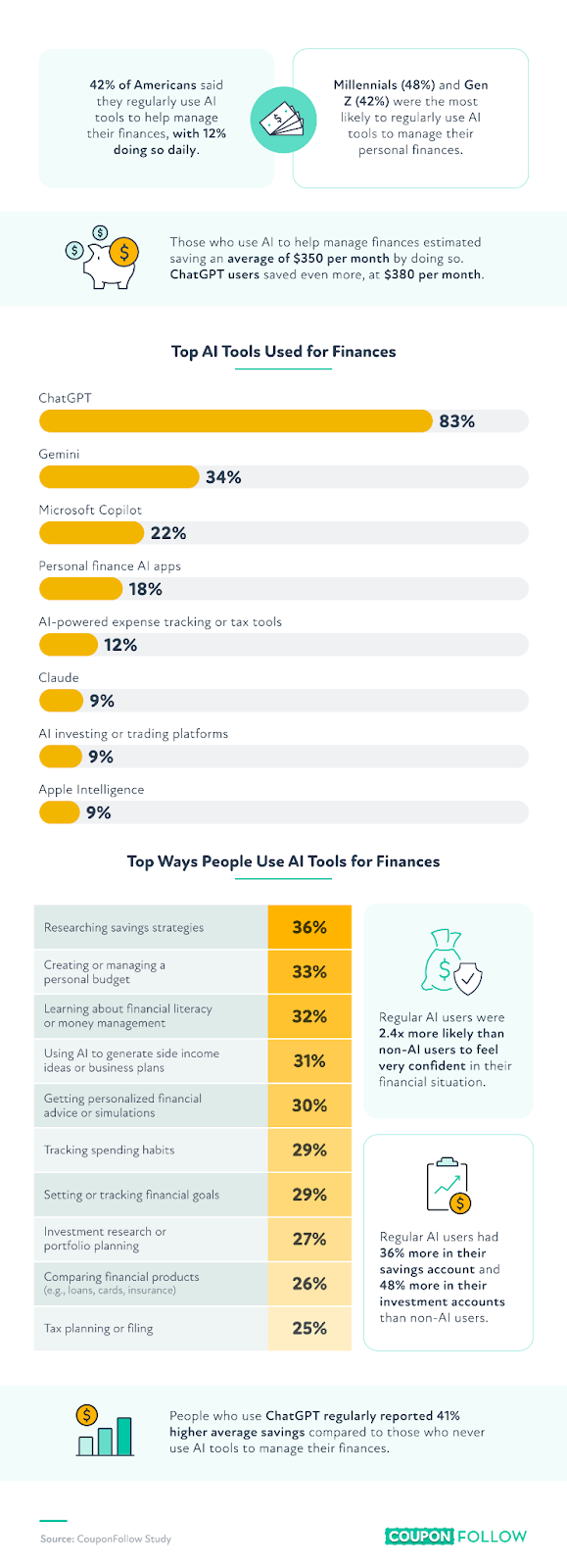

- 42% of Americans now regularly use AI tools to manage their finances, with over 1 in 10 doing so daily. They report saving an average of $350 per month as a result.

- ChatGPT users report saving an average of $380 a month by using AI to manage their finances.

- Regular AI users have 48% more in their investment portfolios and 36% more in their savings accounts than non-users.

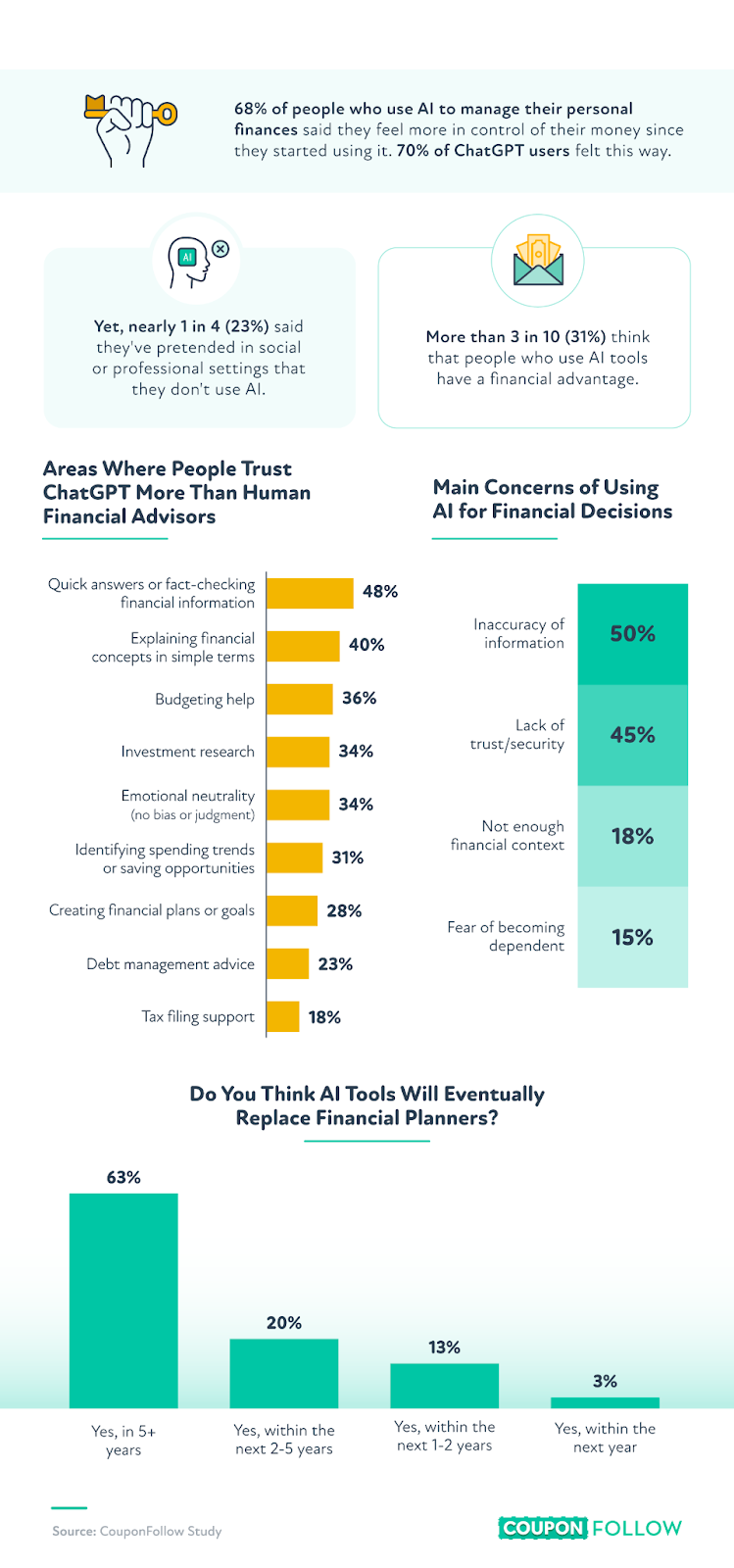

- 63% of Americans believe AI will replace financial planners within the next 5 years or so.

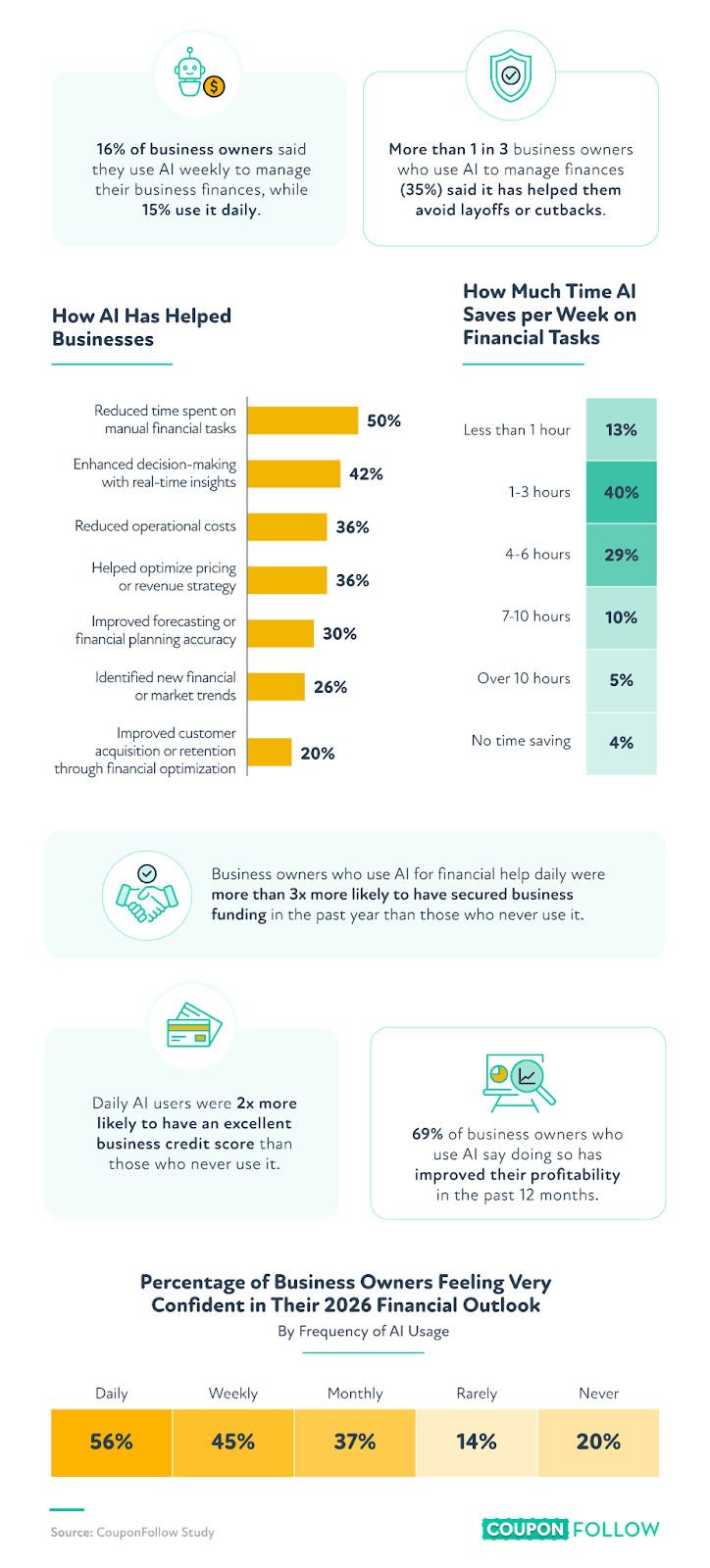

- 15% of business owners use AI daily for financial management, and over a third (35%) say it helped them avoid layoffs or cutbacks.

- Business owners who use AI daily are 3x more likely to have secured funding and 2x more likely to have excellent business credit than those who never use AI.

AI and Personal Finance Use

Many Americans are using AI tools not just for convenience, but for real savings.

Over 2 in 5 respondents (42%) said they rely on AI to manage their money, with 12% reporting that they consult it daily for financial advice. On average, these AI-assisted users reported saving $350 per month. ChatGPT users saved even more, averaging $380 a month by using AI to manage their finances. Regular AI users were also 2.4 times more likely to feel "very confident" about their financial situation compared to those who don't use AI.

When it comes to building wealth, AI users are ahead of the game. Those who regularly use AI for money management had 48% more in investment portfolios and 36% more in savings than non-users. ChatGPT users saw even greater gains, holding 41% more in savings accounts compared to those who never use AI tools.

AI may also be fueling entrepreneurial ambitions. Over a quarter of respondents (26%) used AI to help launch a side hustle, taking advantage of tools to generate ideas, plan budgets, or forecast earnings.

Top Financial Milestones Achieved With AI

- Lowering monthly expenses

- Creating a consistent budget habit

- Starting a side hustle

- Building emergency savings

- Improving credit score

Trust, Perception, and the Future of AI in Finance

While AI is helping many consumers feel more in control, some concerns remain.

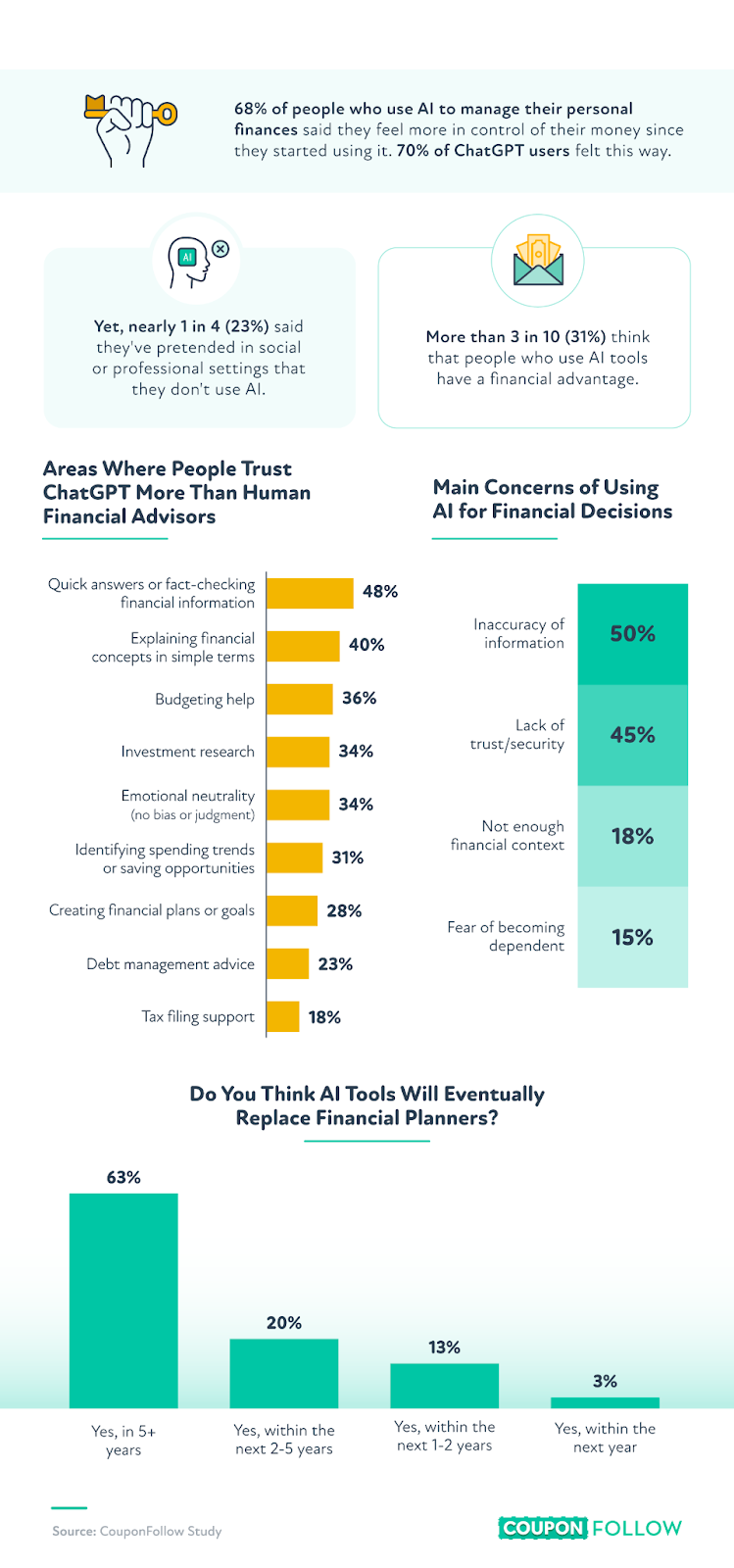

Among AI users, 68% reported feeling more confident about their finances since adopting these tools. Slightly more ChatGPT users felt this way (70%). Still, half of the users pointed to inaccuracies as a concern of AI-generated financial advice. Another 45% expressed worries about security or trust.

Despite these concerns, many Americans seem to believe these tools will improve. Over half (63%) believe AI will replace traditional financial planners within the next 5 years or so.

Business Owners Turn to AI for Stability and Growth

Business owners aren't being left behind in the AI revolution. Here's how they're using AI tools for financial help, and the benefits they're seeing.

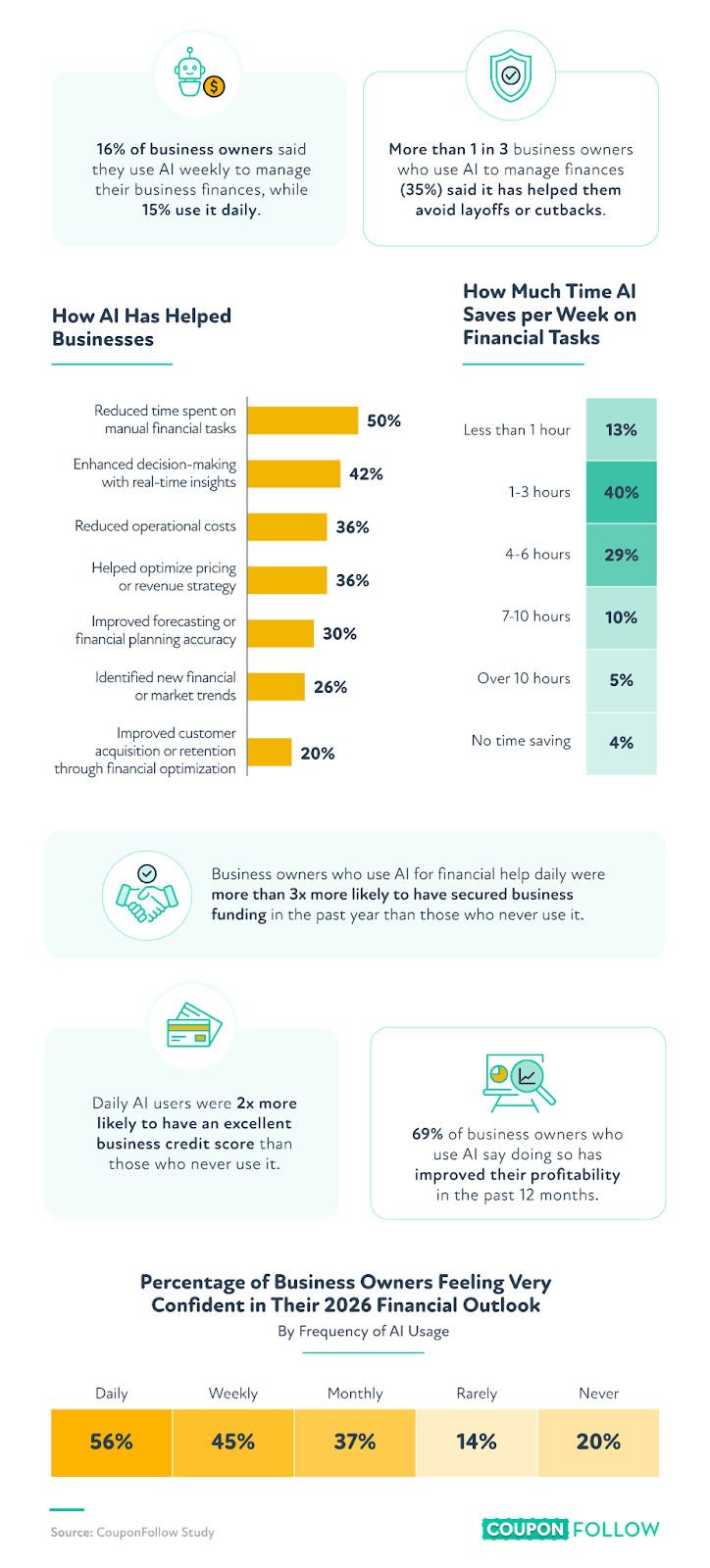

Among business owners surveyed, 15% said they use AI daily to manage business finances, while another 16% do so weekly. These early adopters are seeing substantial benefits.

More than one-third of business owners who use AI said it helped them avoid layoffs or cutbacks. Many also experienced gains in key financial areas. For example, daily AI users were three times more likely to have secured funding in the past year compared to non-users. They were also twice as likely to have an excellent business credit score.

Perhaps most compelling, 69% of AI-using business owners said profitability improved in the past year, which shows AI's potential to drive smarter, more efficient operations.

Top Business Financial Tasks AI Is Used For

- Budgeting or cash flow management

- Pricing strategy optimization

- Bookkeeping or expense tracking

- Financial document automation

- Forecasting revenue or expenses

Smarter Spending Starts With Smarter Tools

AI tools are quickly becoming a go-to for people looking to stay on top of their money. Whether it's sticking to a budget, finding ways to save, or making business decisions, regular users are seeing better results and feeling more confident. As AI gets easier to use and more accurate, it could work hand-in-hand with other money-saving tools like CouponFollow to help shoppers save both time and money every day.

Methodology

A survey of 800 Americans and 209 business owners was conducted on October 24, 2025, to explore the relationship between AI usage and financial health. Respondents shared their AI usage habits and self-reported financial information, including savings, credit scores, and investment activity. Business owners also provided insights into business credit, funding access, and profitability. Survey responses are self reported.

About Coupon Follow

Whether you're stocking up on essentials or shopping for something special, CouponFollow makes it easy to find verified promo codes that actually work. With thousands of deals from popular retailers, it's a smart, simple way to keep more money in your wallet every time you check out.

Fair Use Statement

Feel free to share this content for noncommercial purposes. Just include a link back to this page with proper credit to CouponFollow.