With new tariffs already taking effect, and the potential for more on the horizon, Americans are rushing to make purchases before prices climb even higher., Americans are rushing to make purchases before prices spike. From consumers stocking up on essentials to small businesses adjusting pricing strategies, the fear of cost increases is driving a wave of economic urgency.

CouponFollow surveyed 800 consumers and 200 small business owners across the U.S. to see how this pressure is shaping real-time spending decisions. The results show a nation acting fast to beat inflated prices.

Key Takeaways

- Over 1 in 3 Americans (36%) have made a recent purchase specifically to avoid future price hikes.

- 1 in 5 Americans (20%) have made a larger or more impulsive purchase than usual out of fear of future price hikes.

- Over 4 in 5 Americans (83%) don't trust that businesses are raising prices only when necessary due to tariffs.

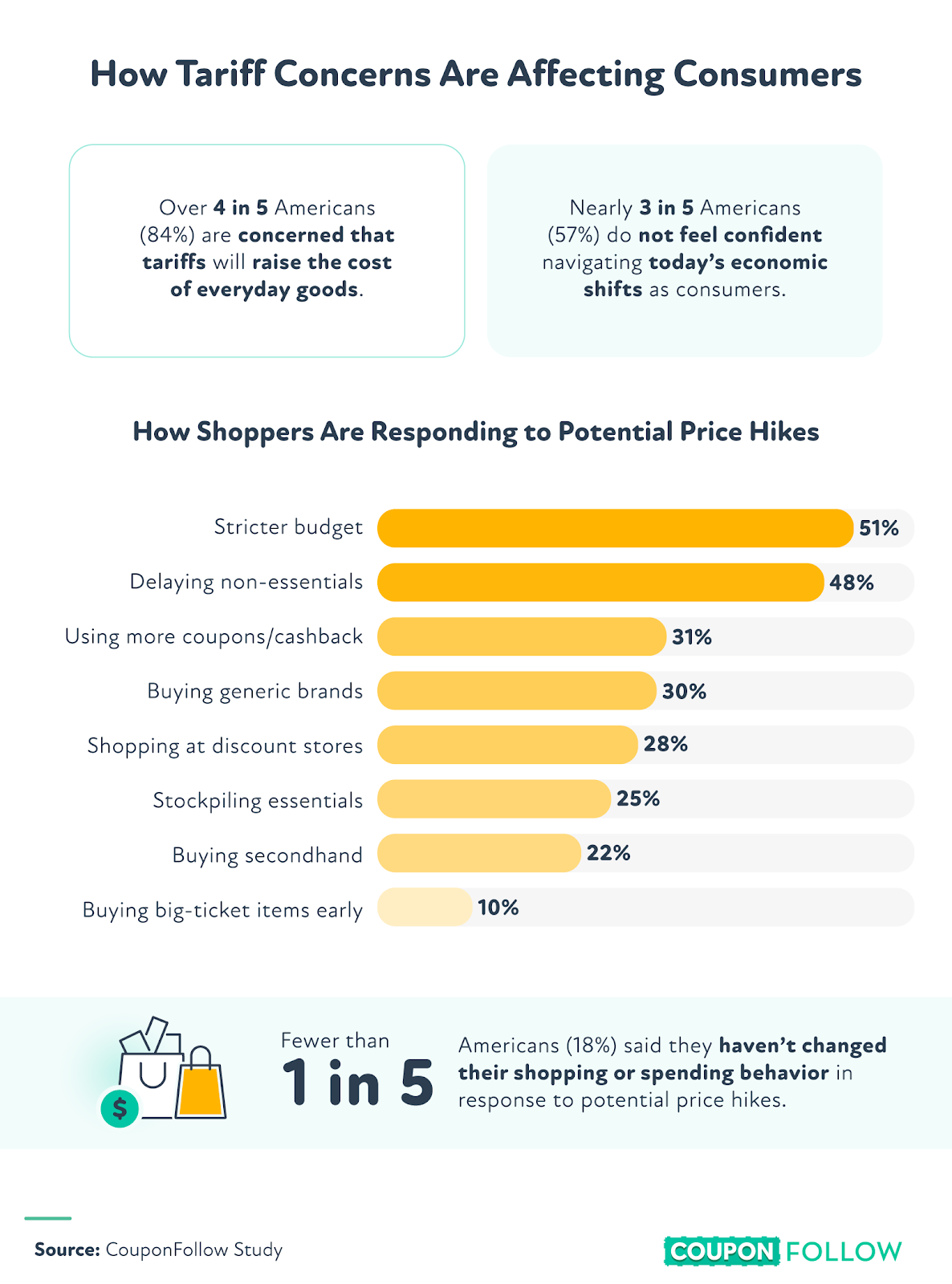

- More than 4 in 5 Americans (84%) are concerned that tariffs will raise the cost of everyday goods.

- Over 1 in 3 small business owners (37%) don't feel prepared to explain price increases to their customers.

- About 2 in 3 small business owners (66%) expect tariffs to affect their operations in the next 12 months, and 94% anticipate a negative impact.

- 1 in 2 small business owners (51%) say their customers have become more price-sensitive in the past 6 months.

Consumer Buying Behavior Is Shifting Fast

Americans are adjusting their spending habits in anticipation of rising prices. Whether it's stocking up on essentials or acting fast on larger purchases, consumers are trying to stay ahead of tariff-induced inflation.

Over 1 in 3 Americans (36%) have recently made a purchase specifically to avoid potential price hikes due to tariffs, and 1 in 4 are stockpiling essentials.

1 in 5 Americans have made a larger or more impulsive purchase than usual because they fear future price hikes.

1 in 10 consumers are buying big-ticket items sooner than they planned in order to avoid price increases, but others are putting these plans on hold.

Top 5 Large Purchases Americans Are Delaying:

- A vacation or leisure travel: 25%

- New appliances or electronics: 23%

- A new car or vehicle: 20%

- Home renovation or repair: 19%

- Furniture or home decor: 18%

More than 4 in 5 Americans (84%) worry that tariffs will drive up the cost of everyday goods, and a nearly identical share (83%) don't believe businesses only raise prices when it's necessary due to tariffs.

Concerns about tariffs raising prices, by generation:

- Gen Z: 90%

- Millennials: 87%

- Gen X: 78%

- Baby boomers: 70%

Concerns about tariffs raising prices, by region:

- Northeast: 88%

- West: 83%

- Midwest: 82%

- South: 82%

How Americans view the impact of U.S. tariffs:

- Create more harm than good for businesses and consumers: 59%

- Depends on the industry or product: 20%

- Necessary tool to protect American industries: 14%

- Unsure/No strong opinion: 7%

Top categories Americans are most worried will become more expensive:

- Groceries: 79%

- Household goods: 46%

- Gas or energy: 42%

- Electronics: 36%

- Clothing or apparel: 26%

- Travel and transportation: 15%

- Furniture/home items: 9%

Over 1 in 3 Gen Zers (34%) and nearly 3 in 10 millennials (29%) say they don't feel confident navigating today's economic shifts as consumers.

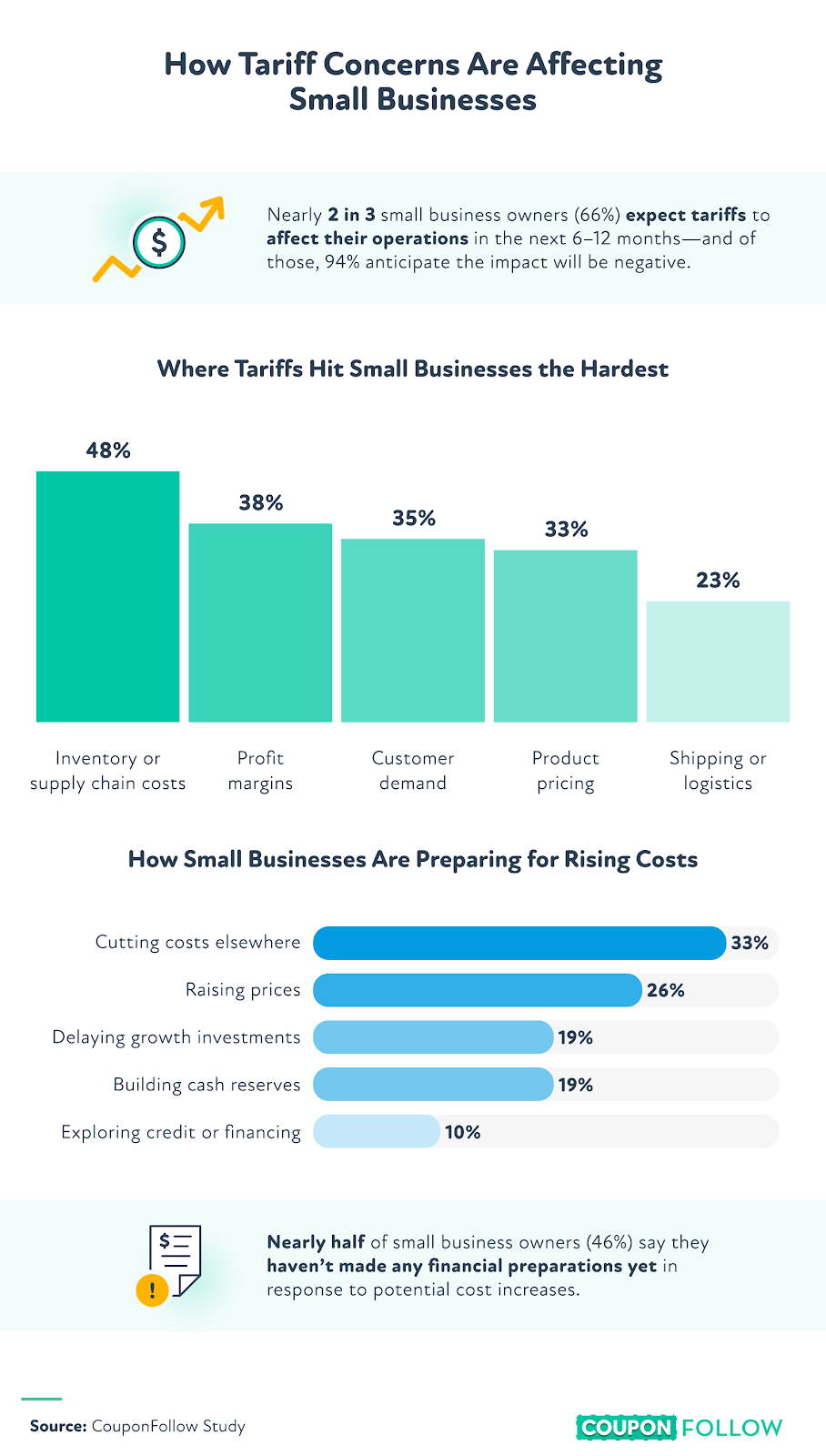

Small Businesses Are Feeling the Pressure, Too

Small businesses are facing their own version of economic uncertainty.

Rising tariff concerns are forcing many to make tough decisions about pricing, inventory, and customer communication.

66% of small business owners expect tariffs to affect their operations in the next 12 months, and 94% anticipate a negative impact.

64% of small business owners have yet to make any changes in response to tariff concerns, but others have:

- Stocked up on inventory early: 20%

- Adjusted pricing ahead of increases: 14%

- Communicated pricing changes to customers: 12%

- Paused or delayed vendor orders: 10%

- Changed suppliers or sourcing: 10%

How small business owners view the impact of U.S. tariffs:

- Create more harm than good for businesses and consumers: 53%

- Depends on the industry or product: 22%

- Necessary tool to protect American industries: 18%

- Unsure/No strong opinion: 7%

How small business owners perceive tariff headlines:

- Accurate, a real concern: 51%

- Underreported, it's worse than portrayed: 26%

- Overhyped, not likely to have much impact: 23%

Industries Most Likely to Be Affected by Rising Tariffs

- Manufacturing

- Retail

- Real estate

- Marketing

- Construction/Trades

51% of small business owners say their customers have become more price-sensitive in the past six months, meaning shoppers are more focused on finding the best deals and less willing to accept higher prices.

37% of business owners admit they don't feel ready to explain price hikes to shoppers.

Conclusion: Planning Ahead in an Uncertain Economy

With prices in flux and tariffs on the table, both consumers and businesses are making fast, strategic decisions to stay ahead. From stockpiling groceries to delaying vacations or shifting supplier relationships, the pressure is real and growing. For budget-conscious shoppers, now is the time to keep a close eye on spending and stay flexible.

Methodology

We surveyed 800 American consumers and 200 American small business owners to investigate how tariff changes are reshaping both consumer and business behaviors. Among consumers, the average age was 40; 50% were female, and 50% were male. Generationally, 6% were baby boomers, 30% were Gen X, 46% were millennials, and 18% were Gen Z. Among small business owners, the average age was 47; 53% were female, 45% were male, and 2% were non-binary. Generationally, 14% were baby boomers, 49% were Gen X, 29% were millennials, and 8% were Gen Z. The survey data was collected in May 2025.

About Coupon Follow

CouponFollow helps online shoppers save time and money by tracking the web's best deals and promo codes. Visit the site to start saving instantly at your favorite stores.

Fair Use Statement

Feel free to share this content for noncommercial purposes. Just include a link back to this page with proper credit to CouponFollow.