From groceries delivered to your door to streaming your favorite show with a click, convenience has become a cornerstone of modern life. But all that ease comes at a cost, sometimes a much higher one than we realize.

A new CouponFollow survey of 1,006 U.S. adults reveals just how much Americans are overspending in the name of convenience. The results show a growing tension between saving time and maintaining financial stability, especially among younger generations.

Key Takeaways

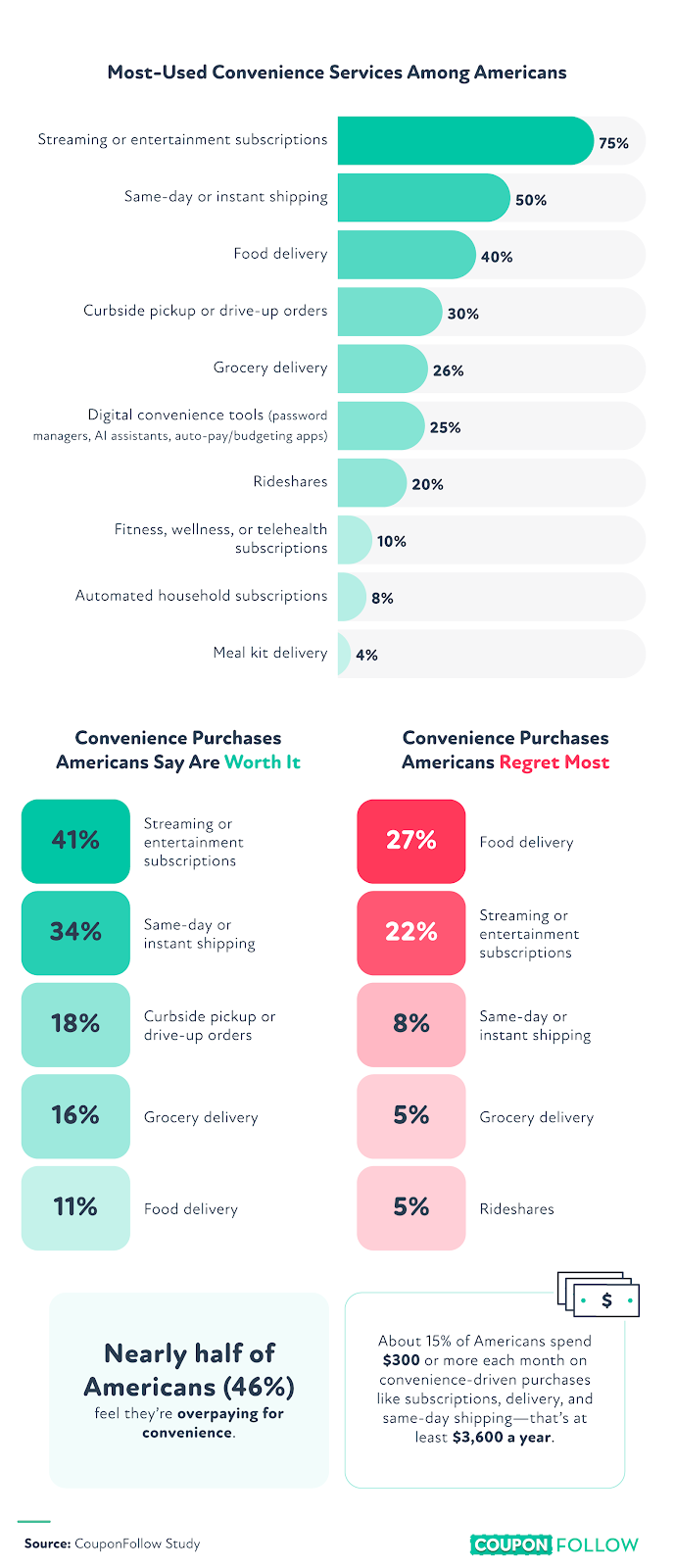

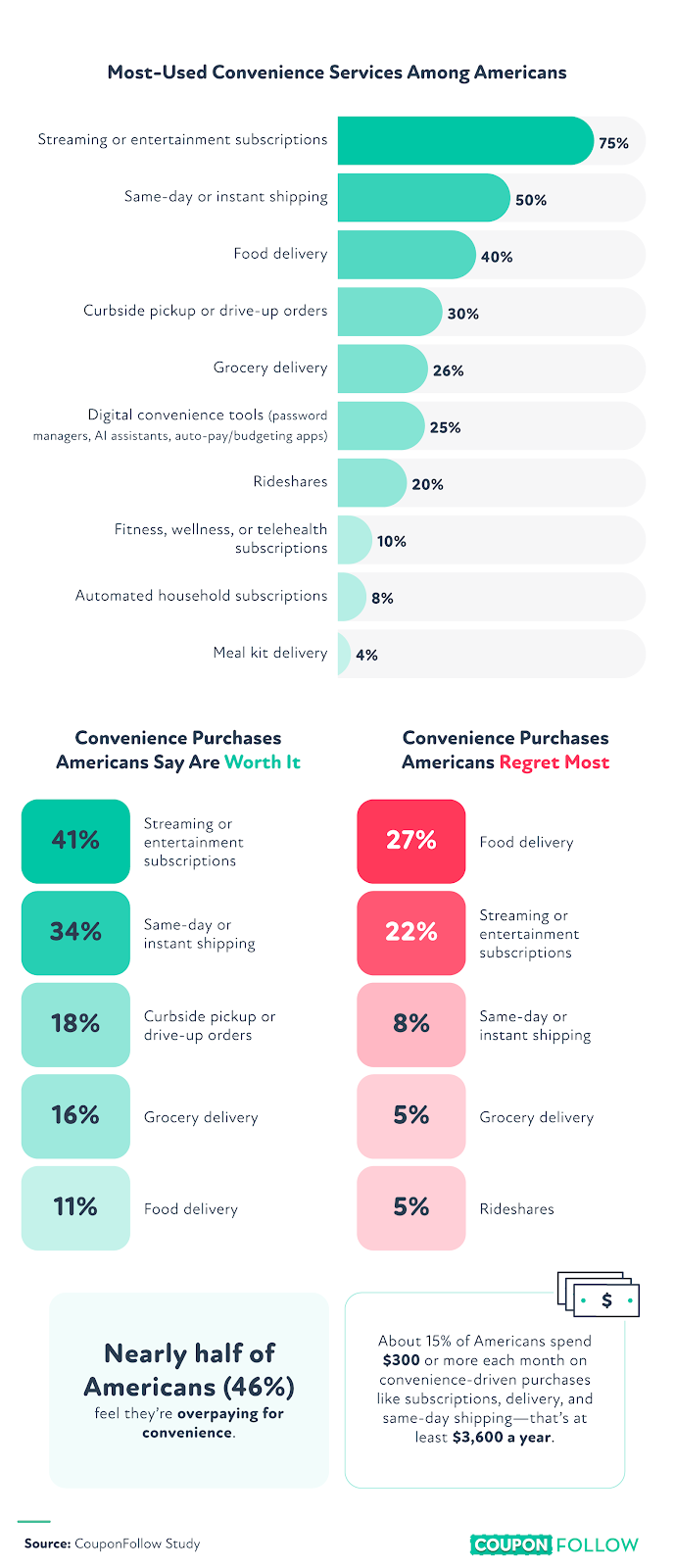

Nearly half of Americans (46%) feel they're overpaying for convenience.

About 15% of Americans spend $300 or more each month (that's at least $3,600 a year) on convenience-driven purchases like subscriptions, delivery, and same-day shipping.

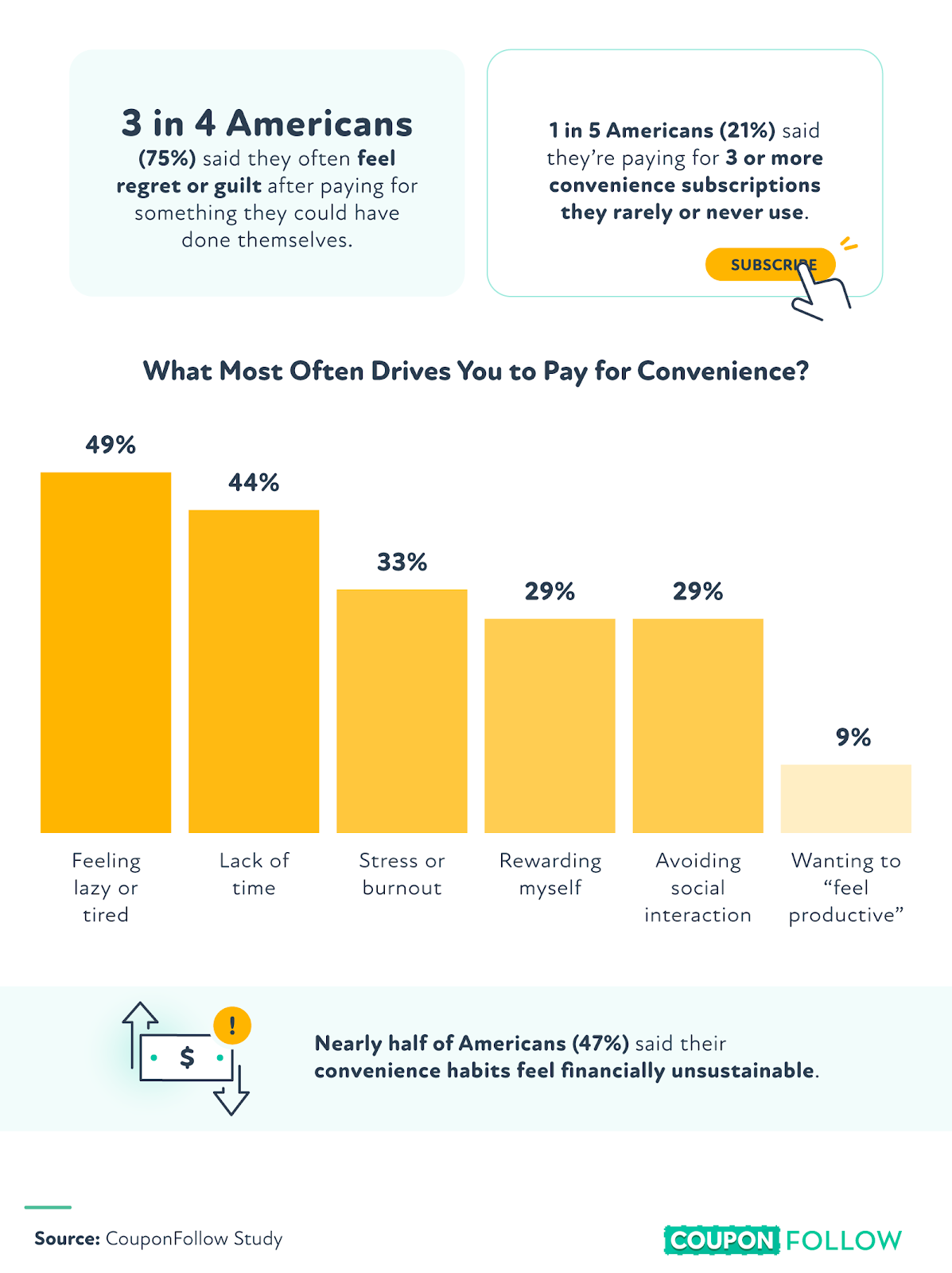

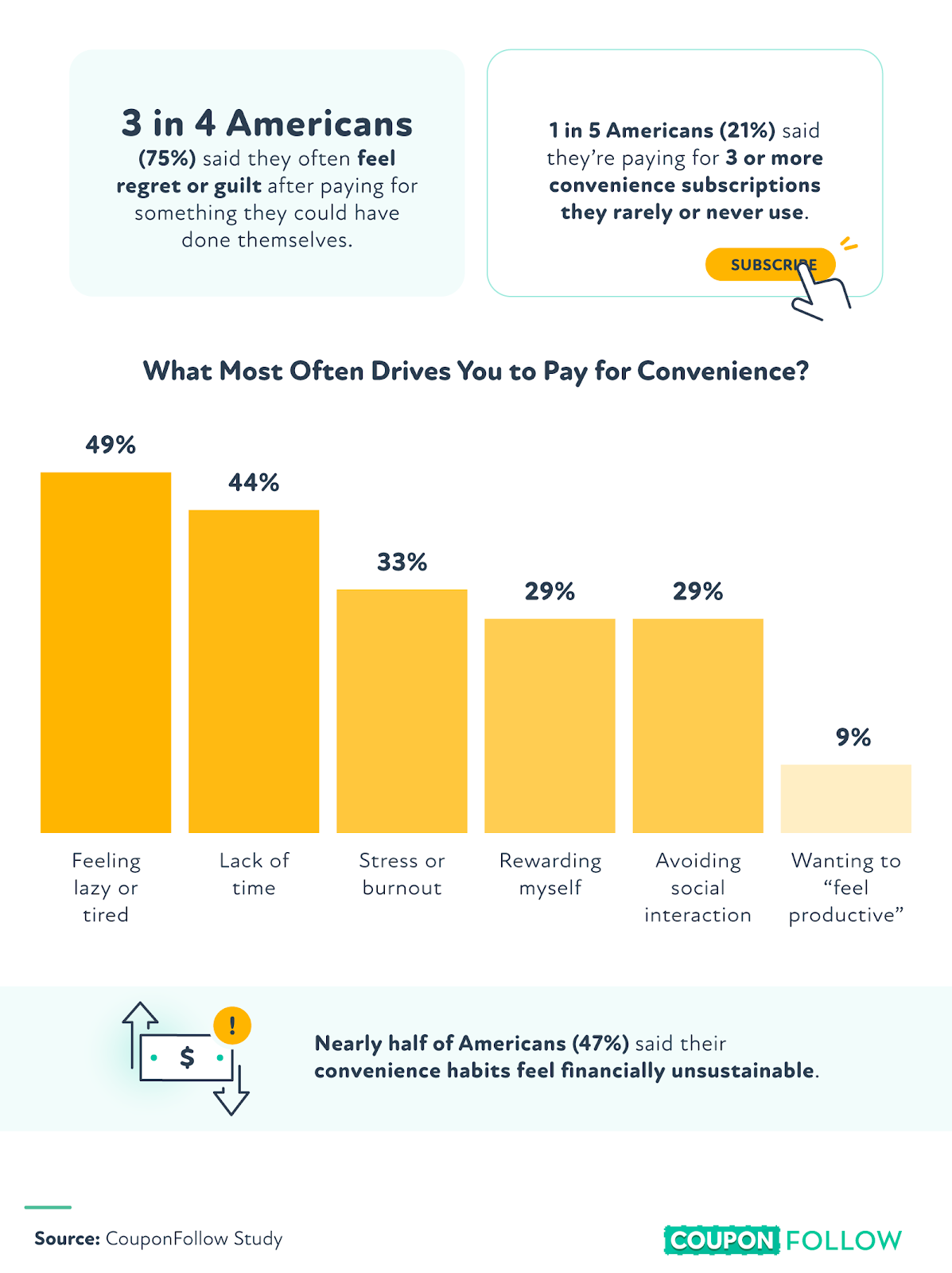

3 in 4 Americans say they often feel regret or guilt after paying for something they could have done themselves.

DoorDash, Uber Eats, and Amazon Prime are the top platforms Americans feel most guilty spending on.

About 1 in 5 Americans (21%) say they're paying for 3 or more convenience subscriptions they rarely or never use.

47% of Americans admit their convenience habits feel financially unsustainable.

How Much Convenience Really Costs

Even small time-saving decisions, like ordering takeout instead of cooking or opting for same-day delivery, can add up quickly. Across generations, Americans are spending thousands each year to avoid everyday hassles.

On average, people spend around $150 per month, or nearly $1,800 a year, on convenience-driven purchases. For about 15% of Americans, these costs soar to $300 or more per month, totaling at least $3,600 annually. Streaming services, food delivery apps, and rapid-shipping memberships are among the most common culprits.

Generational differences tell an even deeper story. Gen X spends the most on convenience at roughly $167 per month, followed by millennials at $154, Gen Z at $136, and baby boomers at $82. Overall, 46% of Americans reported feeling that they're overpaying for convenience services. Millennials (52%) and Gen Z (50%) were more likely to say so than Gen X (38%) and baby boomers (32%).

Many Americans also admitted to cutting corners when it comes to saving money. Nearly 2 in 5 have skipped comparing prices or searching for discounts simply because it felt like too much work, a sign of deal-hunting fatigue. Millennials (50%) are the most likely to skip deal-hunting, followed by Gen Z (43%), baby boomers (38%), and Gen X (36%).

Nearly 3 in 4 Gen Z adults (73%) and 70% of millennials admitted to using same-day or instant delivery services just to avoid going outside or interacting with people. Older generations were less likely to report this, with Gen X at 60% and baby boomers at 40%. When asked when convenience stops feeling worth it, 42% of Americans said it's once they're spending more than $10 just to save 10 minutes.

The Emotional Cost of Convenience

For many, the real cost of convenience can be emotional as well as financial. Guilt, stress, or even secrecy often follow these types of purchases.

According to the study, 3 in 4 Americans often feel regret or guilt after paying for something they could have done themselves. Those feelings are especially common among younger adults, with 82% of Gen Z and 80% of millennials admitting to post-purchase guilt, compared to 67% of Gen X and 56% of baby boomers.

Americans felt the most guilt when making purchasing through these platforms:

- DoorDash

- Uber Eats

- Amazon Prime

- Grubhub

- Netflix

- Restaurant-specific apps

- Instacart

- Disney+

- Uber

- Hulu

Nearly half of Americans (47%) reported that their convenience habits feel financially unsustainable. More than half of Millennials (52%) and Gen Z adults (51%) said their convenience habits feel financially unsustainable, while fewer Gen X (37%) and baby boomers (36%) said the same.

Another 24% of respondents admitted to hiding or minimizing convenience spending from someone close to them, often a partner or parent. Younger generations were the most secretive: 37% of Gen Z and 30% of millennials said they've done this, compared to 18% of Gen X and just 9% of baby boomers.

The most common emotional triggers behind convenience spending were feeling lazy or tired (49%), pressed for time (44%), and stress or burnout (33%). Meanwhile, about 1 in 5 Americans said they're paying for 3 or more subscriptions they rarely or never use, suggesting that some convenience spending often leads to waste rather than relief.

When asked what they'd do if they cut back, 52% of respondents said they'd save or invest the money, and 32% would use it to pay off debt. Two-thirds of Americans summed it up best: Convenience is necessary but too expensive.

When Convenience Costs Too Much

What started as a time-saver has quietly become a financial strain for many people. From delivery fees to unused subscriptions, convenience culture is eating into Americans' wallets and peace of mind. As many begin rethinking these habits, one thing is clear. The luxury of saving time may not always be worth the cost, especially when it leads to guilt and growing financial pressure.

Methodology

In November 2025, we surveyed 1,006 Americans to explore how much Americans overpay for the sake of saving time. The average age was 41; 50% of the participants were female, and 50% were male. Generationally, 8% were baby boomers, 24% were Gen X, 52% were millennials, and 17% were Gen Z.

About CouponFollow

CouponFollow makes it easier for shoppers to save money online. We're a go-to resource for anyone looking to shop smarter and stretch their budget further.

Fair Use Statement

The information in this article may be used for noncommercial purposes only. If shared, please include a link to the original content on CouponFollow with proper attribution.