The concept of "buy now, pay later" has existed since the birth of credit cards. With Klarna, though, you don't need a credit card to break up your payments. You can shop at hundreds of online stores, break up your payment into four installments, and pay off your purchase over the next few months. According to the Klarna website, the service is completely free, with no interest or hidden fees. For most shoppers, Klarna is a godsend. Is Klarna the best option, though, or is this new way of shopping a little too good to be true?

What Is Klarna?

Before Klarna, you had to pay for your online purchases in one lump sum. You could take out a credit card, but you'd have to pay interest, which could extend your payment schedule by months or even years. Klarna allows you to pay in installments without applying for a credit card. You don't need to go through a lengthy application process or worry about the impact on your credit. All you have to do is sign up for an account. Once you're signed in, you can use Klarna to pay for your purchases at hundreds of major retailers.

There is one catch: Currently, you can only use Klarna while shopping online. The app has not made the jump to in-person shopping yet, but that could change in the future.

Overall, Klarna is a great resource for people who enjoy online shopping but who don't have the cash to pay a massive sum up front. Better yet, Klarna actually makes it easier to find deals across the web. When you download the app, you'll be able to add items to your wish list and get notified when the prices of those items drop. You can also take advantage of exclusive deals and discounts offered through the Klarna app. It's a great way to save money and find gifts for everyone, including yourself.

If you're shopping through your web browser, you'll find the option to use Klarna when you check out at participating stores. If you're shopping through the Klarna app, you'll have all the participating retailers right at your fingertips. You can shop, look for deals, pay for your purchases, and track price drops all from the Klarna app.

How Does Klarna Work?

From a high-level you can follow these steps to use Klarna (on any website that supports it)

- First, add items to your cart and look for “Klarna” as an option when you checkout.

- Next, enter your personal details to apply for Klarna and get instant approval

- Finally, complete your purchase and Klarna will send you an email confirmation and remind you when payment is due

You may not be sure which websites support Klarna ahead of time, so to start using Klarna via the app, simply download it right to your smartphone. From there, you can sign up for an account and access all the latest deals. You can shop directly from the app. You'll see the option to pay with Klarna when you reach the checkout page.

So, how do you pay with Klarna, anyway? Currently, the app offers three different options.

The first—and most common—option is paying for your purchase in a series of four installments. The payments are divided equally in fourths. For example, if you spent $80 at your favorite store, each payment would be $20. You'll be charged for the first payment today, and you then pay the rest of your bill in two-week installments. Overall, it takes about two months to pay off your entire bill.

Unlike credit cards, Klarna charges no interest or hidden fees. However, this isn't a loan or a line of credit. You will need to make sure that you have money in your bank account every time a payment is due. You're not using Klarna's money to pay for your purchases; you're using your own money to pay in a series of installments.

The second option involves getting the product today and paying for it 30 days later. This gives you the opportunity to try out your products and return anything that doesn't work out without paying for it. However, keep in mind that you will have to pay the full amount for your non-returned products in 30 days. You're not getting a discount or paying in installments; you're simply delaying your payment date.

The third option involves actually taking out a credit card to pay for your purchases. Klarna partners with WeBank to allow you to apply for credit, qualify for financing, and finalize your purchase all through the app. This can be a great way to help you pay for large purchases. However, you'll have to accept a completely new set of terms when you use a credit card. Klarna will run a credit check on your account to make sure you have an acceptable credit score. You will be responsible for paying the bill on time and paying interest and added fees along with it. If you don't, your credit score might start to drop.

Now that you know how to use Klarna, which stores accept Klarna Pay Later? Next we’ll list a rundown of some of the participating retailers.

Which Stores Accept Klarna?

So many major retailers accept Klarna that it's impossible to list them all. When you download the app, you'll be able to browse Klarna retailers by category to find exactly what you're looking for. These are just some of the retailers that allow you to pay with Klarna:

- Hugo Boss

- Sephora

- adidas

- LG

- COACH

- Rare Beauty

- Apex

- Saks Fifth Avenue

- Pandora

- Etsy

- Foot Locker

- Champs Sports

- Nautica

- Calvin Klein

- Tommy Hilfiger

- Aeropostale

- Diesel

- Finish Line

- Reebok

- Journeys

For the full list of Klarna retailers, download the app or visit the Klarna website.

What Are the Costs Associated With Klarna?

Officially, there are no costs associated with Klarna. The app is 100% free. You don't have to pay for a subscription or pay extra fees when you pay with Klarna. However, you might end up paying extra fees on your purchases if you don't keep a few things in mind.

When you use one of their pay later options, the most important thing to remember is that you're paying with your own money. This isn't like a credit card where you're essentially getting a loan that you can pay off later. You will need to have money in your account every time a payment is due. If you don't, that money is coming out of your account anyway—and your bank might end up charging you for the overdraft.

Additionally, it's important to remember that you're paying full price for the item. Klarna does offer exclusive deals and discounts, but you're still responsible for paying the full discounted amount. When you look at the payment plan, it might be tempting to think that you're really only paying $20 for the product. You'll pay a small amount today and worry about the rest later, right? Make no mistake, though—you're still paying the full purchase price, and that needs to be factored into your monthly budget.

It's also important to remember that credit cards are a completely different beast. Applying for a credit card through Klarna has its advantages, but you will also be responsible for all the fees that come with it. Since you're essentially taking out a loan, you'll have to pay interest on your bill until you get it paid off. If you don't get it paid off quickly, interest can add hundreds or even thousands of dollars to your bill.

What Are the Downsides of Paying Later?

Don't have money for your entire purchase today? Klarna allows you to buy it now and pay it off later when you have the money. This can help you afford products that would otherwise be out of your reach. It's good for people living on a budget, but it also has its downsides.

When you pay the full amount up front, you can pay it off and forget about it. There's no worrying about paying off interest or dealing with the bill in two weeks. You pay the bill and get the product—end of transaction. However, using Klarna forces you to extend the entire process. If you find yourself dealing with unexpected expenses, you'll have to figure out how to pay those along with your upcoming Klarna payments.

Also, let's face it: Sometimes, you just flat out forget about the payments. You thought you had some extra money this week, but when you peeked into your bank account, you found $40 missing. You check your transaction history, and then it hits you—you're still paying for that product you bought a month ago. There goes your gas money for the week!

Klarna can also be addictive. You can access hundreds of stores right from the app, constantly refresh the app to find new deals, and, best of all, only pay a small amount up front. Klarna has its advantages, but it can also be an Achilles' heel for people who are trying to quit online shopping.

Using Klarna During the COVID-19 Pandemic

If you're like most people, you're probably no stranger to online shopping. However, juggling several different websites and keeping up with all your bills could get exhausting after a while. Sometimes, it seems easier to just drive to the store and buy everything in person. Unfortunately, the pandemic has removed that option for a lot of people.

With Klarna, your shopping options are all in one place. Your kids need new shoes? Order sneakers from Reebok. Need to replenish your makeup kit? Place an order with Sephora. Looking for electronics? Grab a new pair of headphones from Bose. You can essentially order everything but your groceries—and some stores even offer limited grocery options. It's all right here, in a single, easy-to-use app.

Klarna also makes it easier to buy holiday gifts. Instead of risking your health by driving to the mall, you can shop high-fashion stores and boutiques through the Klarna app. Thanks to a wide range of categories, you can find gifts for everyone on your list. Makeup, fashion, health, toys, electronics, home goods, entertainment, and more—Klarna is your one-stop shop for pandemic holiday shopping.

Plus, Klarna makes it easier to buy gifts if you're living on a tight budget due to the pandemic. Instead of paying a massive lump sum, you can break your payments into smaller, more manageable chunks. The two-week installment system allows you to pay a portion of your bill shortly after you get paid. You can even take advantage of special deals when you shop through the Klarna app.

Overall, Klarna is great for people who are trying to stay safe in the midst of COVID-19. Once the pandemic is over, you might find that Klarna is so convenient that you continue using it for a long time to come.

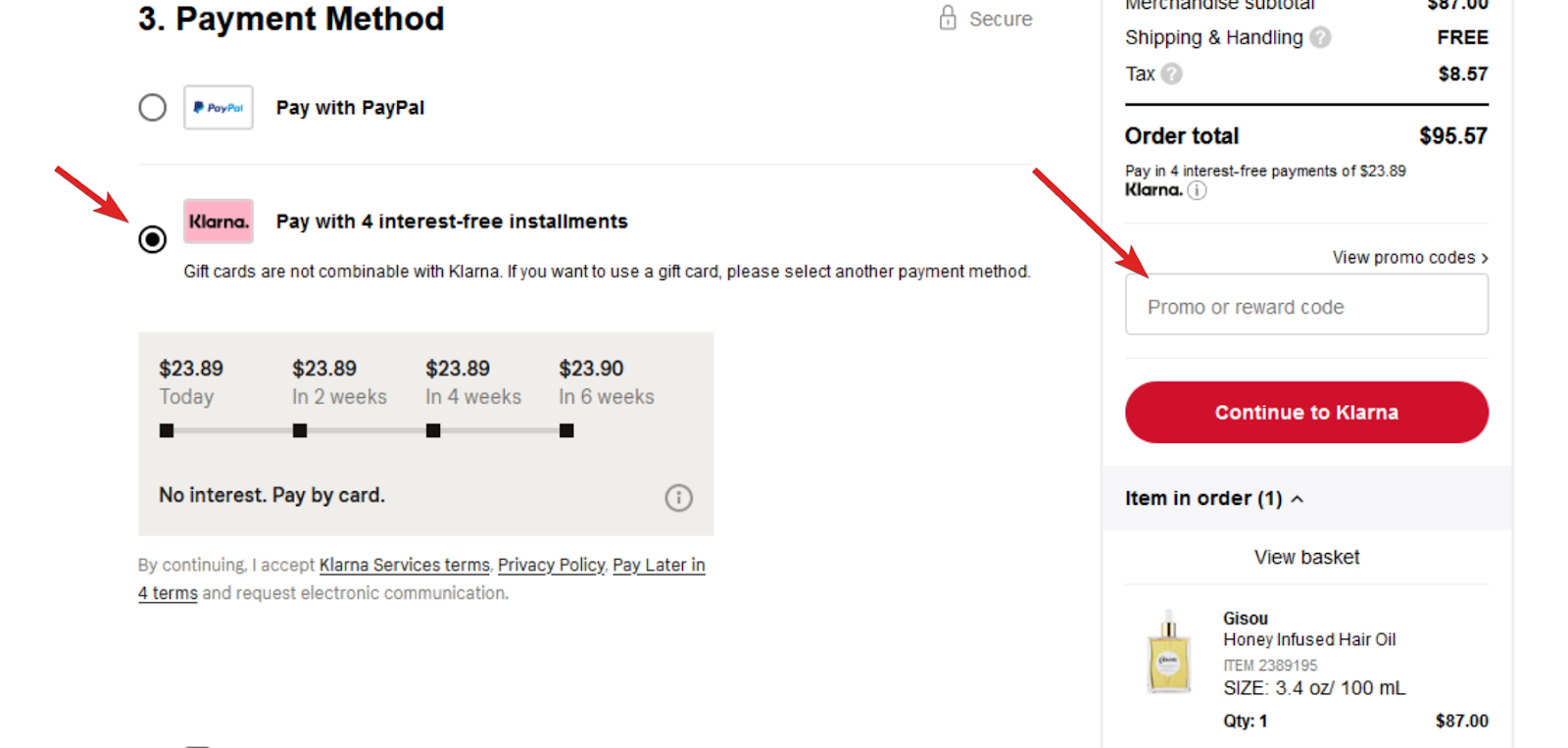

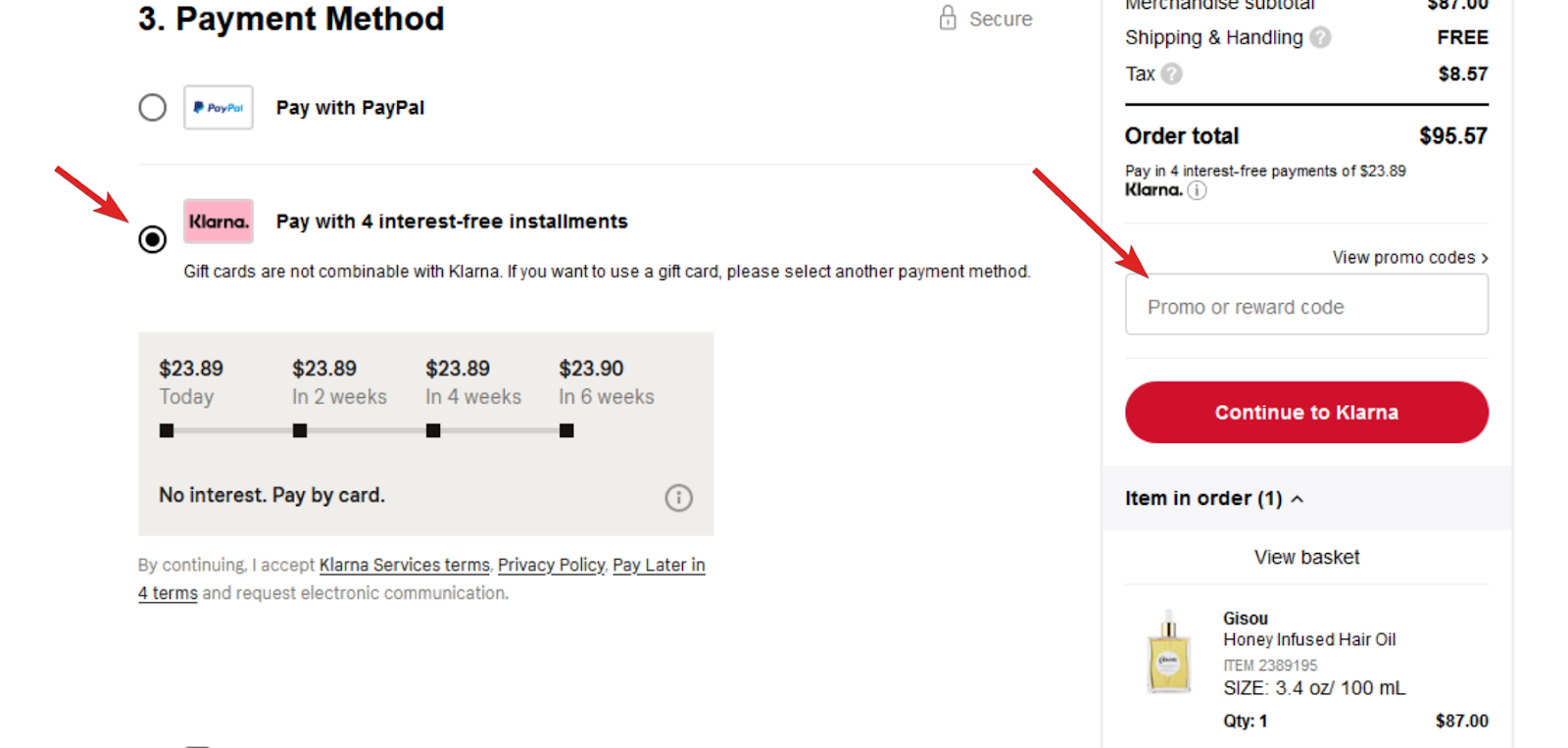

Can I Use Klarna With Promo Codes or Discounts?

Yes, definitely. Klarna doesn’t stop you from applying promo codes during checkout as you normally would. In fact, Klarna is great for people who like to shop for bargains. You can add items to your wish list and get notified when the prices drop. You can combine coupons from CouponFollow with purchases made through Klarna. For example, you can utilize one or more (if the retailer allows coupon stacking) of our Sephora coupons and apply the promo code at the same time you use Klarna. We’ve provided a screenshot below.

Also, you can also track your deliveries through Klarna to make sure they're on their way.

Is Klarna Right for You?

Now it's time to answer the question that's likely on everyone's mind: Is Klarna right for you? Ultimately, it depends on how you use it. If you use Klarna responsibly, it can offer more flexibility when you're shopping online. If you're a little too overeager, though, using Klarna can land you in a lot of trouble.

Before you download the app, here are a few questions you should ask yourself:

- Are you good at bargain shopping?

- Can you keep track of a two-month payment plan?

- Do you always make sure you have money in your bank account before buying a product?

- Do you stick to your budget every month?

- Can you stop online shopping before you spend too much?

- Do you only shop online for necessities?

If you answered "yes" to one or more of these questions, Klarna might be the app for you. This app is great for people who can shop responsibly. You can easily access your favorite stores, pay when you get the chance, and try out products before paying in full. Plus, it's an easy way to sign up for a credit card if you need a new line of credit to build up your credit score.

So, what types of people wouldn't benefit from using Klarna? If you're addicted to online shopping, this probably isn't the best app for you. Scrolling through hundreds of stores and seeing price drops can encourage you to spend too much money in the long run. You could also add to any debt you already have since this app makes it easy to apply for a credit card.

This also isn't the most ideal app for people with bad credit. Whenever you sign up for an installment plan, Klarna performs a soft credit check to make sure that you have good credit. You don't need an impossibly high score, but if your score is too low, your request for a payment plan might be denied.

Who Are the Top Klarna Competitors?

Klarna isn't the only delayed payment app on the market. One of their most popular competitors is Afterpay, a company that was originally founded in Australia. Like Klarna, Afterpay allows you to set up an interest-free payment plan. Unlike Klarna, Afterpay doesn't perform credit checks, so you might want to try this option if your credit isn't the greatest.

Sezzle is another newcomer to the shopping market. Similar to Klarna and Afterpay, Sezzle allows you to break up your purchases into smaller installments. Sezzle currently works with over 20,000 stores and services, including Wings and Horns, Reigning Champ, and Crunchyroll.

Affirm offers a comparable delayed payment platform. Unlike Klarna, though, Affirm operates entirely through personal loans. You might have to pay interest on your payments, but Affirm allows you to make large purchases that you wouldn't otherwise be able to afford.

Wrapping It Up

Overall, Klarna is one of the most exciting advancements in the world of online shopping. You can get your products today and pay later without worrying about high interest rates adding on to the price of your initial purchase. It's simple and flexible, and it operates entirely through a single app, including shipping and returns. Even if you prefer paying up front, you can still take advantage of the sales, discounts, and price drop notifications offered by Klarna. With ties to hundreds of major retailers, Klarna is one of the world's biggest online payment apps. Sign up today and see how you can start saving and shopping more freely.