The FAFSA is a form needed in order to be eligible for many kinds of student loans and aid. What does "FAFSA" stand for? It's the Free Application for Federal Student Aid.

Don't think you can afford college? You're not alone. Roughly 85% of all first-year students are awarded college financial aid for their study at four-year institutions. But in order to get that help, you have to apply for financial aid through the U.S. Department of Education. Use this FAFSA guide to help you not only apply for aid but understand what your financial options are.

We're going to run down some basics, some terms, and the simple process of how to apply with the FAFSA. Application tips are good, but it's also very important that you understand what you'll see in return and what you'll be signing up for. Which loans will have federal help in terms of interest? Which type of student financial aid is preferred? We'll cover this and much more!

The FAFSA is a form needed in order to be eligible for many kinds of student loans and aid. What does "FAFSA" stand for? It's the Free Application for Federal Student Aid.

The forms typically become available for the next year in early October, and the FAFSA deadline is typically in late June. Note that your state will have its own FAFSA due date as well, so if you're hoping for state aid, too, check when your deadlines will be. The best month to fill out the FAFSA is January, or really as early as possible, since some schools award aid on a first-come, first-served basis.

Here's a quick checklist of FAFSA requirements:

To qualify, you must be a U.S. citizen or eligible non-citizen (permanent resident, refugee, or other select cases), have a Social Security number (or alien registration number), and have a high school diploma or GED. You must be entering or enrolled in an eligible degree program, and you must maintain satisfactory academic progress. You cannot apply if you're in default on a current loan or have a drug conviction.

Yes, you need a FAFSA renewal every year, which means your aid and eligibility might change.

It's easy to get lost in the weeds with details on the form, so here's a basic rundown of what things mean as you come across the terms in your application:

Here's a quick rundown of what the process will be like:

After you fill out your FAFSA, student loan option will begin to be presented to you. Here are some different things you might see in your results and what they mean:

Grants don't require repayment; loans do. It's pretty easy to see why so many students would rather have grants. They can also be referred to as scholarships. Take some time to look up and apply for scholarships before or after you fill out the FAFSA.

You may also qualify for a federal Pell Grant; these are awarded to undergrads based on financial need.

The Federal Perkins Loan Program is a very low-interest loan program that's for students with exceptional need. The school serves as the lender. The limit is $5,500 per year, and the term is typically 10 years.

The William D. Ford Federal Direct Loan Program offers direct loans also known as Stafford loans, for which the U.S. Department of Education is the lender. The limit is between $5,500 and $12,500 per year, and the terms, interest, grace period rules, and other factors depend on whether your Stafford loan is subsidized or unsubsidized.

Direct subsidized loans are Stafford loans that have been subsidized (just like it sounds) by the federal government. This means that the U.S. Department of Education pays the interest while you're in school, during the grace period of six months after you graduate, and during periods of deferment.

Direct unsubsidized loans are Stafford loans that don't get federal help, so you'll need to pay interest while you're at school, during grace periods, and during deferment periods. On the up side, though, these loans aren't based on financial need, and pretty much everyone can get them.

Usually, a student who's demonstrated high financial need in their FAFSA will have a mix of grants, a federal Perkins loan, and a direct subsidized Stafford loan, with private and unsubsidized Stafford loans filling in the gaps. But there are also other forms of help:

If you find yourself saying, "It's too much money; what do I do?" then note that once you receive the information back, you usually won't have to sign a Master Promissory Note (MPN) immediately. Take some time to consider your financial options, apply for a few more scholarships, map your next few financial years using some handy calculators and tools, and even consider adding more colleges to your list. There are a lot of ways to pay for college and a lot of strategies for bringing down costs.

Let's say that once your top-choice school, backup school, and safety school all look at the data from your FAFSA, loans and other aid won't be enough for you to feasibly go to college. Don't stress! You can go back in and make FAFSA corrections to add schools that you may have not even considered. Smaller liberal arts colleges may give you more help, and you can always consider state schools, which have cheaper tuition and sometimes their own state funds for college aid as well.

In special circumstances, if you did not see enough help in your SAR to go to school, you may be able to do a FAFSA appeal. Here are those circumstances:

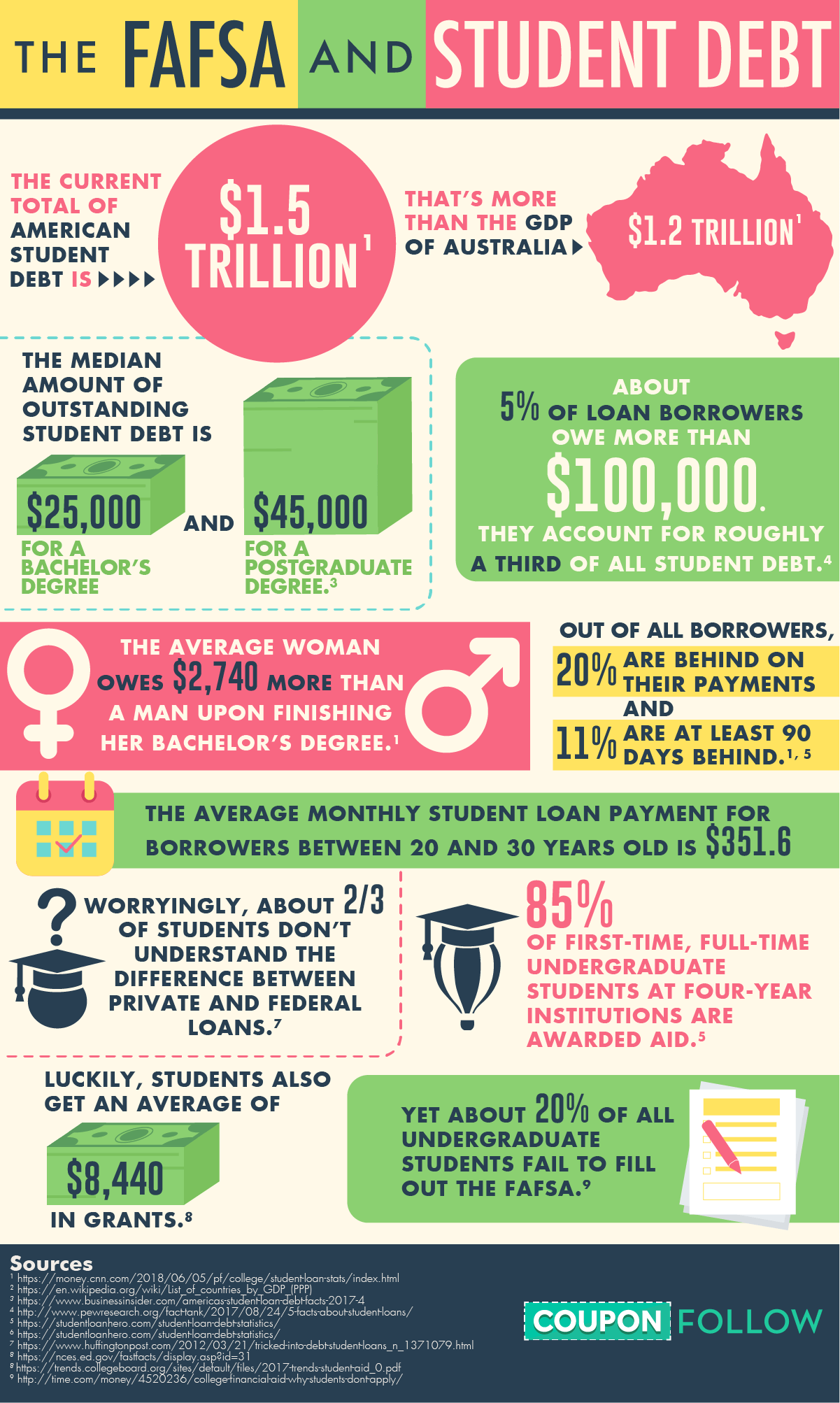

Here are some surprising statistics about student debt and how FAFSA fits into the mix.

If you've got your information and are trying to fully understand it, use some calculators to figure out what your monthly payment is going to be like after college. (We like the visualized calculator by The New York Times!)

Remember: You can always apply for more scholarships to get grant money that doesn't need to be paid back!

As far as the incidental costs of college, there are other things you can do to help lighten the load. You can save on textbooks by buying used or online. Many colleges charge astronomical prices for textbooks which can cost students thousands of dollars each year. You can save hundreds of dollars each semester by buying textbooks used or online. Thriftbooks has thousands of used textbooks discounted up to 75% off the original purchase price. Thriftbooks coupons can help students save up to 15% off textbooks every semester.

You can live off-campus to avoid the rising costs of dormitory living. If you need to buy furniture for your new apartment Overstock offers huge discounts on great brands for furniture and appliances. If you are interested in furnishing your apartment or dorm room make sure to use a verified Overstock coupons. You can save up to an additional 30% off on their already discounted prices.

No matter what you are looking to buy you will probably be shopping on Amazon at some point. If you are an active college student you can use the Amazon Prime student discount to get a 6 month free trial for Amazon Prime. After the free trial ends you still get a 50% discount on Amazon Prime as long as you are in school.You can check out our list of student deals so that you can save on activities, clothing, and electronics. Or you could always check our coupons for miscellaneous expenses!